Indians have a special corner for Bikaneri Bhujia and thus made it the National Namkeen of the country. Bikaji Foods lead the Bikaneri Bhujia market by being its largest manufacturer as well as of taking the credit of making it popular Internationally. As our analyst provide Bikaji Foods IPO review.

The company has now come up with its IPO. It aims to raise about Rs 881.22 crores through this. However, the huge sum of money will go to the existing shareholders (after expenses and tax deductions), the company will not get proceeds from this.

Let’s analyze company more closely :

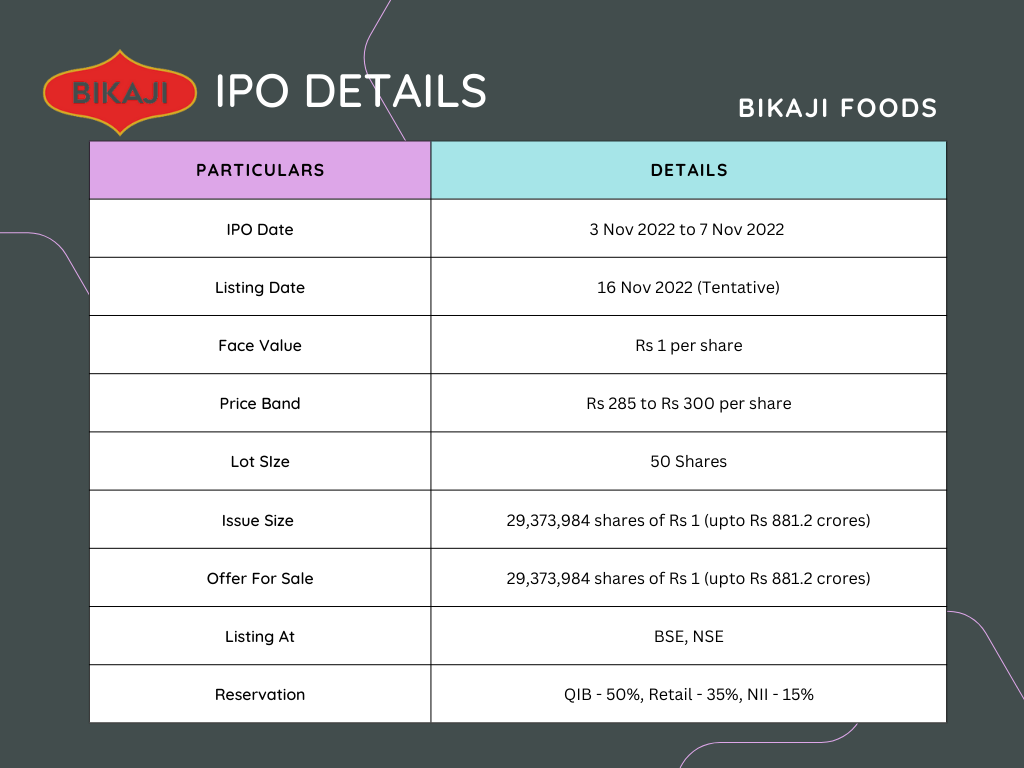

IPO Details

About

- Mr. Shiv Ratan Agarwal incorporated Bikaji Foods in 1995. He is the grandson of Mr. Gangabishan Agarwal, founder of the Haldiram brand.

- Fastest growing company in organized sweets industry in India

- Internationally present

- Third largest ethnic snacks Indian company

Products

The company majorly has 5 kinds of products. In order of contribution to revenue –

- Bhujia: 34.98% of sales

- Western Snacks: 8.64% of sales

- Nakeem: 39.18% of sales

- Sweets: 7.57% of sales

- Papad: 6.57% of sales

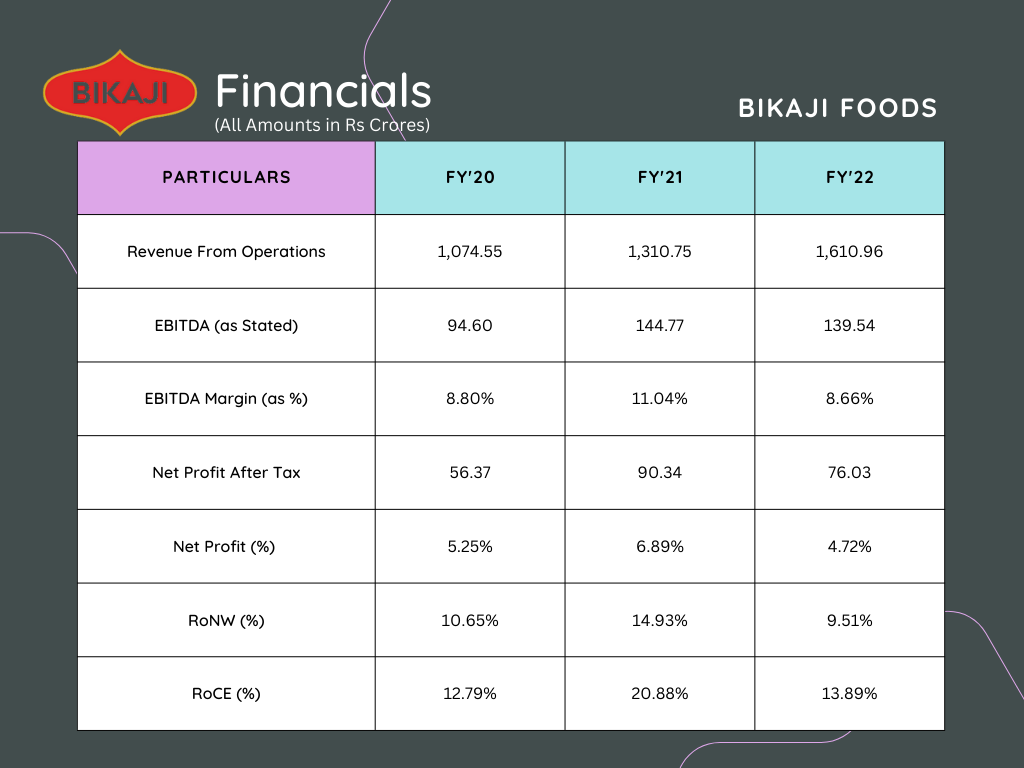

Financials

Moreover, the company had an average EPS of 3.06 for FY’20 to FY’22 and a RoNW of 11.7 during the same time period

Its Debt to Equity ratio increased from 0.10 in FY’20 to 0.14 in FY’21 to 0.19 in FY’22

Growth Potential

- Diverse Geographies and Top Selling Products – With different products being popular in different areas, the company may plan on following different strategies to focus on each market segment individually.

- Brand Image – Trying to partner with high end stores in the category to increase brand visibility and brand equity

- Technology – Focusing on digitalizing their distributors and superstockists by giving them a comprehensive system to manage distribution.

- Manufacturing Units – New contracts for manufacturing units in Kolkata can increase presence in Eastern India. The company also aims to introduce new units to increase reach.

Unique Selling Propositions

- Brand Name – Bikaji Foods is a well established band name that ensures quality and taste at reasonable prices. The consistency in products has made the brand reputable in the industry.

- Product Diversity – With over 300 products across segments, the company has mastered the Indian taste palate.

- Strong Distribution Network – Around June 2022, they had 6 depots, 38 superstockists, 1956 indirect & 416 direct distributors pan India.

- Location of Manufacturing Facilities – The company strategically placed its large scale facilities around places with easily available raw material and increased distribution facilities to reduce logistics and freight costs.

Risks

- Dependency on Single Product – Around 35% of total sales comes solely from Bhujia. However, its production takes place in a single factory in Bikaner. Any mishap in the single factory can thus affect the production. Also, if the brand doesn’t evolve or diversify with the changing tastes, Bhujia soon might not be able to sustain the pressure of being the top product

- Geographic Concentration – The core market of the company is concentrated in just 3 states – Bihar, Rajasthan and Assam with about 72% of total sales from here. Therefore, any disruption in these areas or operational issues might affect the sales.

- Unanticipated Delays – The company’s future plans of expansion and adding manufacturing facilities are contingent on stable costs and no delays. Thus, anything going differently can impact the strategy and future growth.

- Dependence on Distributors – Although inhouse production is present, the company still depends heavily on its distribution channel. As a result, any issue with a big distributor can be a major setback for the company.

- Investments in Unsecured Debt Instruments – The company has made heavy investments in unsecured debt instruments of Hanuman Agrofood as compulsorily convertible debentures of Rs 106.23 crores as well as optionally convertible debentures for Dadiji Snacks of Rs 11.5 crores

Should you Apply?

The company showcases a healthy rise in revenues & profits, stable margins, a dominating market presence, and scope for growth.

According to the current GMP the IPO is expected to list at a premium of Rs 40-50 but we expect the GMP to tumble further as It is being priced at a P/E of close to 100. This is not a kind valuation for the new investors. As this is also an OFS (offer for sale) so no new money will flow into growing the business. We recommend not to apply for this IPO but do your own research.