A major wind power O&M service provider, Inox Green Energy engages not only in long term O&M services for WTGs and wind farm projects but also common infra facilities on wind farms that support power evacuation from WTGs.

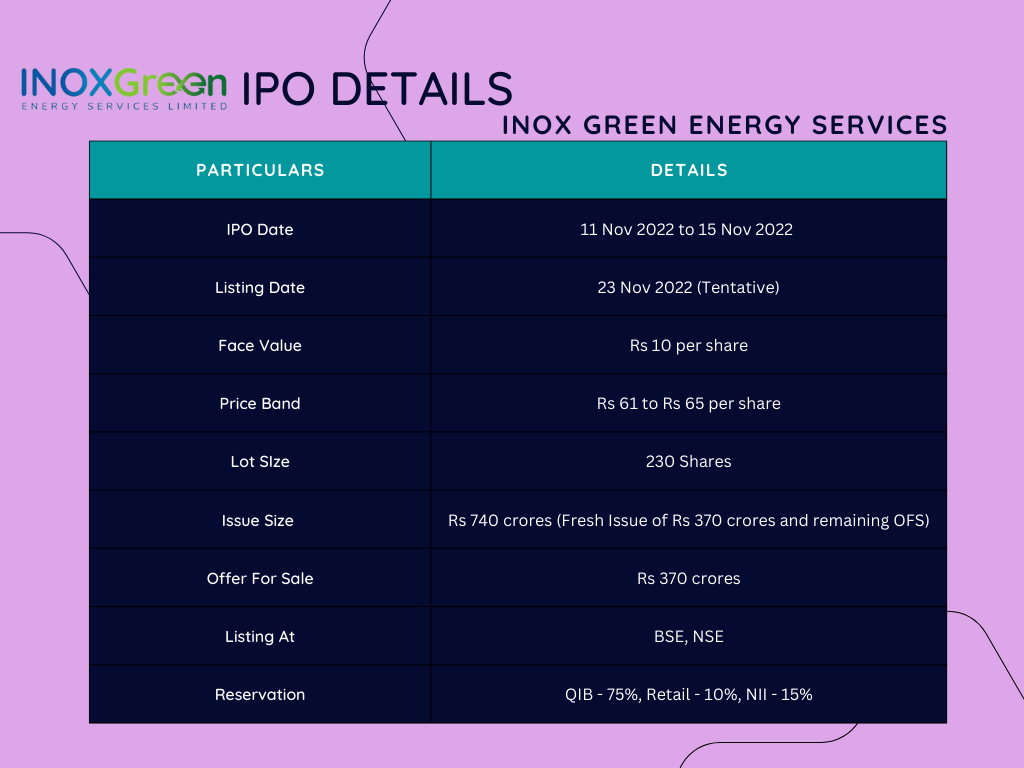

The company, a subsidiary of the listed Inox Wind Ltd, is launching its IPO on 11 November 2022.

It aims to raise Rs 740 crores with 50% acting as Offer for Sale and 50% as fresh issue. However, the Rs 370 crores from Fresh Issue will be utilized for repaying debt as well as general corporate purposes.

The company is also currently heavily dependent on its parent company for business.

Let’s dig deeper into the facts to know whether this acts as a good investment!

IPO Details

Services

Engaged in 2 main services –

- Maintenance Services that involve detecting potential component failures or repairing them if it happens

- Operation services with a 24*7 on site team at customer’s wind farms to help WTGs generate highest possible yield

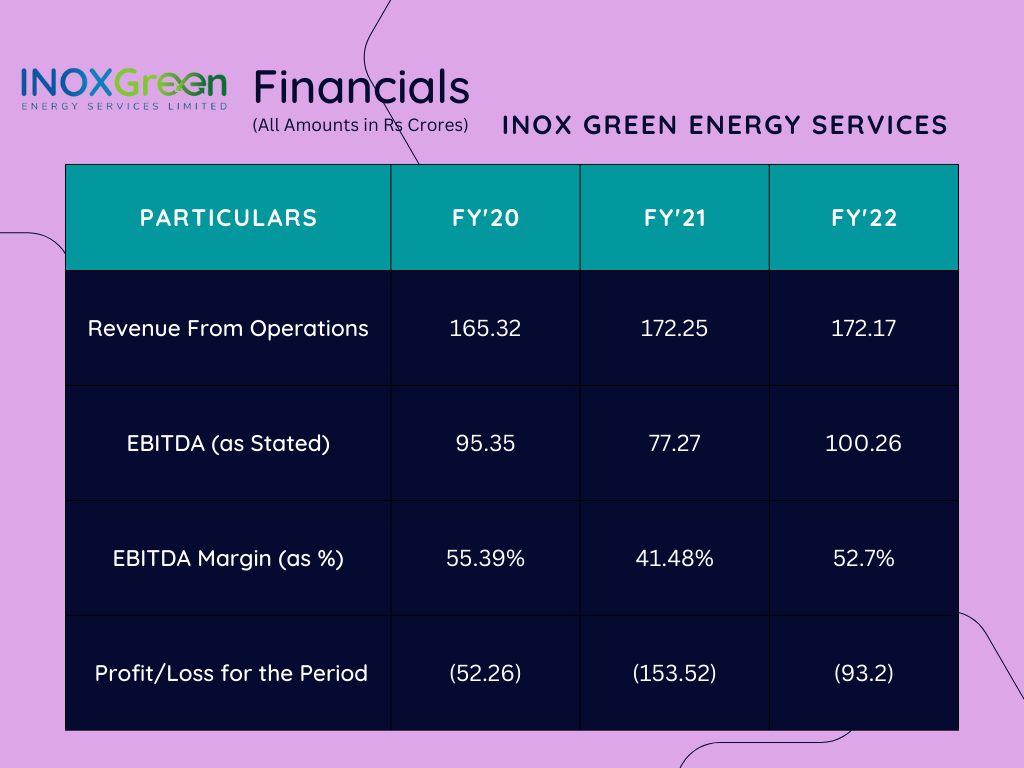

Financials

Note –

- No significant rise in revenues

- Average EPS of (0.78) and RonW of (21.3)%

- Rise in Debt to Equity ratio from 0.73 (FY’20) to 0.99 (FY’22)

Growth Potential

- Expand Business – By signing more O&M long term contracts with for all kinds of customers and not only the ones that buy IWL’s WTGs can help company expand business

- Predictive over Reactive Maintenance – Focusing on predicting equipment failure is better than repairing it later and the company wants to focus on the same.

- Analytics & Performance Forecast – By adopting new technology, aim to provide asset performance and analytics services to clients in order to maximize benefits

- Asset-Light Model – Company aims to transition to a model with lesser CapEx, reduced project bids, etc

Unique Selling Propositions

- Reliable Cash Flow – Long term contracts with customers have a range of 5-20 years with higher chances of renewal.

- Established Supply Chain – They have good relationships with their suppliers of tools, components or parts

- Brand Name – Well established and good Performance for the past 9 years

Risks

- Loss Making – As seen in financials, the company incurred losses for the past three financial years and it is unclear when it will be profitable

- Dependency on Parent Company – IGESL is entirely dependent on IWL for their business. Any change in this can be devastating for the company

- Contractual Obligations – Another subsidiary of IWL, Resco Global Wind Services, imposes some obligations on the company due to an agreement in which IGESL divested their commissioning, procuring and erection business to them.

Should You Apply & Current GMP?

Although the company is one of the major players in the sector in India and there is high growth potential in the sector , the other side still cannot be ignored. With losses for the past few years; proceeds of IPO going into clearing debts and no concrete business plan ahead; low GMP; the investment is highly risky. Looking at the parent company that got listed about 7 years back at Rs 450 is still trading at Rs 150.

The lower number of pros and high cons make this an unattractive investment.

Do check out our Bikaji Foods IPO review.