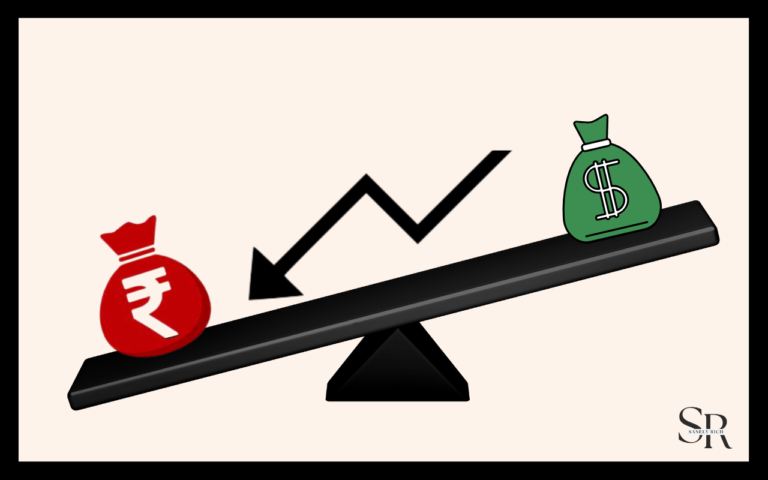

15th August 1947, the Independence day of the beautiful country – India, Remarkably was also the day when 1 Rupee was exactly equal to 1 USD. Fast forward to 13th May 2022, the Indian currency hits an all-time low of INR 77.704 for 1 USD. But what’s the reason behind this plummeting of Indian currency despite outperforming its Asian peers?

Currency Returns vs. US Dollar over the last year…

Turkish Lira: -45%

Argentine Peso: -20%

Japanese Yen: -16%

Polish Zloty: -15%

Euro: -13%

British Pound: -13%

Australian Dollar: -10%

Swiss Franc: -8%

Canadian Dollar: -7%

Indian Rupee: -5%

Chinese Yuan: -4%

Russian Ruble: +11%— Charlie Bilello (@charliebilello) May 12, 2022

History Of Indian Rupee Against US Dollar

#RupeeVsDollar from 1947 to 2021

13th May 2022 the exchange rate of 1 USD is INR 77.704.

The value of a nation's currency fluctuates primarily because it is based on supply and demand. pic.twitter.com/KporteWaRO

— Saksham Makani (@sakshammakani) May 14, 2022

The Indian currency first started to be measured against US Dollar after India became Independent in 1947. The value of 1 INR at that time was 1 USD because our net balance sheet was fresh with no credit or debit.

The value of the Indian currency started depreciating in the 1950s because of the rise in loans from the International market. The situation was worsened by the Indo-China war in 1962 and the Indo-Pak war in 1965. This resulted in the value falling to INR 7.5 for 1 USD by 1967.

Further in the 1970s, the rupee kept falling because of the Oil crisis when OAPEC decided to reduce its production. India had to take various loans to tackle this situation. Other factors like the political crisis in the 1980s caused huge setbacks to the economy & the rupee reached the exchange value of as high as 17.50 by the end of 1980s. The devaluation of currency due to the economic crisis in the 1990s was a huge factor for the rise in exchange rate.

The current exchange rate of 1 USD is 77.704 INR which is an all time high exchange value. Lets look at the reasons of this freefall :

The Pandemic

When the pandemic struck in 2020 it shattered the economy, millions lost their jobs and people had to live their lives differently. Companies filled for bankruptcy and the government had only one way to save the economy-print money! They overflew the market with liquid money by printing notes to help the economy and it did till a certain point.

Now some of the money printed made its way to India – FIIs invested heavily in Indian economy in 2021 – it is estimated to be over $30billion. Now with increase in interest rate the fed is looking to bring back the money that made its way to India.

US Fed Rate Hike & Inflation

The US Fed increased the interest rate by 0.5%, the highest increase in the interest rate in over 20 years. This happened because inflation is at its multi-decade high. The rise in interest rate makes borrowing expensive, directly impacting the revenue of companies and ultimately plummeting the stock prices. This panic causes the global investors to sell their investments in exchange for widely accepted US dollar. The impact is rise in value of US dollar because of high demand.

Exodus Of Foreign Institutional Investors From India

India is currently facing one of the worst selling by the FIIs since 2008 crisis. In 2022, overseas investors withdrew funds worth $4.14 billion, out of which $2.3 billion was withdrawn in month of May itself.

The Rise In Crude Oil Prices

India is one of the largest importer of crude oil thus making it one of the most vulnerable. Increase in crude oil directly impacts the cost of production hence causing the consumer to purchase at high prices. All this results in inflation impacting the US dollar to gain strength as a result Indian currency hits an all-time low.

The Impact On Stock Market

The companies that import raw materials or have a high foreign borrowings will take the biggest hit by this.

– Negatively Impacted Sectors by depreciating currency : Oil, gas, metals & auto

– Positively Impacted Sectors by depreciating currency : Export based : IT, pharma, textiles etc. As they receive more money for the same amount of goods.

Tip : One can also invest in International funds in this situation.

Very well explained in simple terms.

Good read 👍🏻👌🏻

[…] just this, individuals with outstanding unpaid taxes who miss the deadline also pay an interest of 1% per month on outstanding amount post the due […]