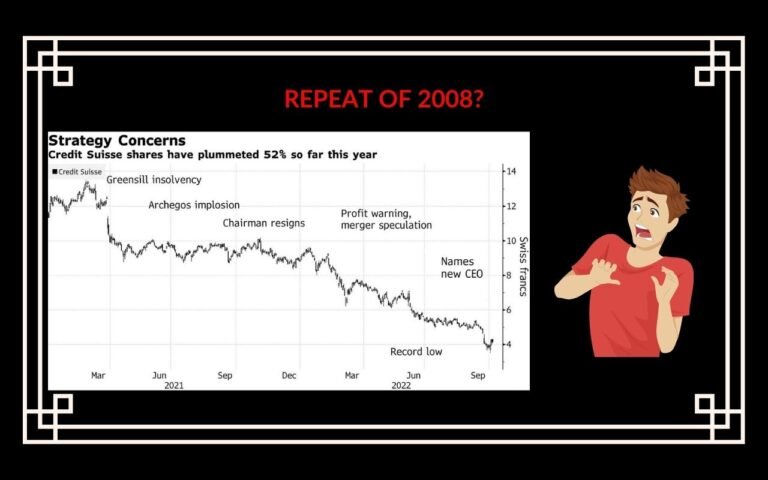

The last quarter has been critical for Credit Suisse. The 166 year old bank saw a price drop by over 56% in the last year. It witnessed its lowest trading revenue in last quarter. The comparison with the downfall of Lehman Brothers is inevitable.

The Investment Banking arm of the company is facing severe issues. With economic slowdown, not many companies are looking to raise funds or debt. The losses are bundling up and and the business is way down to recover them. However, more investment banks like Goldman Sachs and JP Morgan saw a profits and business reduction, yet CS alone was impacted so heavily?

This is due to the involvement of the company in endless scandals over the past few decades. Be it involvement with the mafia, money laundering, corruption and more – Credit Suisse had its share in all. It also saw 2 of its major money making companies collapse. Let’s have a look at some of these scandals to understand the lack of trust in the company and their accumulation of losses.

1) Fake Names for The Philippine president and first lady (1986)

The Philippine president and first lady, Ferdinand and Imelda Marcos, stole $5bn to $10bn from the country. Credit Suisse aided this by opening their accounts under fake names to avoid scrutiny. It later returned $500mn of the stolen money to the country.

2) “Shredding Party” (1999)

The employees’ at the Tokyo branch had a “shredding party” of destroying evidence regarding an investigation into whether it was helping clients hide their losses. The derivatives arm, Credit Suisse Financial Products, had to lose its license and pay a fine. Tokyo operations of 4 other units was suspended as well.

3) Funds Linked to Corruption by Nigerian Dictator (2000)

CS accepted funds of about $214mn with a link to corruption by the then Nigerian Military Dictator. It faced criticism for its failure to recognize that his 2 sons had political exposure. The lender assured improvement in monitoring procedures and firing of the related staff.

4) Japanese Yakuza and Money Laundering (2004)

A CS banker got arrested with the accusation of helping launder more than 5bn Yen with a link to Japan’s largest Yakuza gang. Later on proving that he was unaware of the source of funds, he got acquitted.

5) Breaching US Sanctions (2009)

For deliberately evading US Sanctions against certain countries (like Iran & Sudan), CS was fined $536m. The giant ensured that it was taking internal actions and enhancing its procedures.

6) Tax Evasion, Germany (2011)

About 1100 German clients of the bank investigated that it was evading tax. Credit Suisse settled the claim for €150m.

7) Sub-Prime Bond Fraud (2012)

4 CS bankers were charged for purposely overstating the prices of subprime bonds ( $3bn ) during the 2007 crisis. 1 formed MD was jailed.

8) Tax Evasion, US (2014)

When a former UBS banker turned a whistleblower, it uncovered the bank was helping Americans evade taxes for some decades. It pleaded guilty and paid $2.6bn as fine.

9) Tax Evasion, Italy (2016)

With yet more allegations for helping clients dodge taxes and conceal funds, CS setlled with Italian authorities for 109.5m Euros

10) Fine for Anti Money Laundering (2016)

For the deficiencies in its anti money laundering program, CS paid $16.5m in fines to a US regulator. It assured them to work internally and take appropriate measures.

11) 1MDB related fine for Anti Money Laundering (2017)

CS breached money laundering rules during transactions related to 1MDB which was then in the middle of a $4.5bn scandal for corruption. SIngaporean regulator fined the bank $700K for the same.

12) Tax Evasion, Europe (2017)

Under suspicion of tax evasion again for 55K accounts, investigations were done against employees of CS in Germany, UK and Australia. The bank cooperated with authorities and clarified a zero tolerance policy for evasion of tax.

13) Weak Anti Money Laundering Controls (2018)

After identifying shortfalls with deals like Fifa, Venezuelan state oil company, PDVSA and Brazilian oil corporation Petrobras, regulators ordered CS to improve its anti money laundering controls

14) Lescaudron fraud (2018)

Patrice Lescaudron, a former CS banker, admitted to forging client signatures, divert money, make bets without clients’ knowledge and losing $150m during it. Amongst many clients was former Prime Minister of Georgia who is still trying to recover funds. With a 5 year prison sentence, he killed himself just 2 years later in 2020. CS assured that no other employee was a part of this practice.

15) “Jobs For Business” Scandal, Hong Kong (2018)

Credit Suisse admitted to a corruption scheme where it offered jobs to friends and family of Chinese officials so as to win their business. They ended up paying $47m as fine to US authorities.

16) Corporate Espionage (2019)

Caught in a corporate surveillance scandal where it hired private detectives to spy on 2 outgoing executives. They later admitted to this and 5 more such cases. This led to exit of chief executive, Tidjane Thiam. It later banned surveillance “unless required for compelling reasons, such as threats to the physical safety of employees”.

17) Bulgarian Drug Trafficking (2020)

Allegedly failed to run proper tests and check source of funds related to a Bulgarian drug cartel which laundered more than $146m during 2004 to 2008. The criminal trial began in February 2022. CS doesn’t accept these claims and is willing to fight it.

18) Collapse of Archegos (2021)

With the collapse of Archegos Capital Management in 2021, CS faced losses worth $5.5bn due to risky exposure. 23 staff members faced consequences and 9 faced termination of employment. It also assured that Risk Management will be a priority in future.

19) Greensill Capital (2021)

Credit Suisse was repackaging and selling loans of Greensill Capital, the supply chain lender. The underlying loans were highly risky. Greensill collapsed and CS forcefully suspended $10bn worth investor funds. The bank is still making efforts to get back its money and. It claims that it took actions against many individuals.

20) Tuna Bonds, Mozambique (2021)

The scandal drew International attention with over 20 people facing huge amounts of money laundering and corruption charges. CS was responsible for organizing loans worth $1.3bn for 2 Mozambican (state owned) companies. It was meant to buy ships for tuna fishing and coastguard. However, huge sums of money actually ended up in private pockets. Today, atleast $500mn is unaccounted. $200mn was lost in bank fees, 3 CS employees admitted accepting bribes and various politicians and individuals showed involvement. The ships actually bought at highly inflated rates are rotting at ports unused.

CS will be paying $475mn in fines and writing off $200mn worth loans. Moreover, it lost credibility and trust yet again.

21) Resignation of Chairman

Post making news for breaking covid quarantine rules twice due to personal entertainment reasons, António Horta-Osório resigned from the company. His actions reflected negatively on the company’s respect to policies and regulations.

But is the bank really going to collapse?

It is taking measures to not make this a reality. With a focus on its Wealth Management arm, which is doing a lot better, it aims to double the revenues from there. It will restructure the Investment arm into 3 parts – a “bad bank” to hold high risk assets, an advisory business and lastly the rest of the business. In order to achieve this, it plans on raising more money. Unfortunately, that adds to its problems – Due to downgraded credit rating, it faces a higher borrowing cost and reduced share prices make it unfavorable for current investors to sell stake. So, it will sell some assets – again reducing the future earning prospects.

However, will it be able to survive these heavy costs while retaining its employees? That is something only time will tell but as of now, the future of the bank seems highly uncertain.